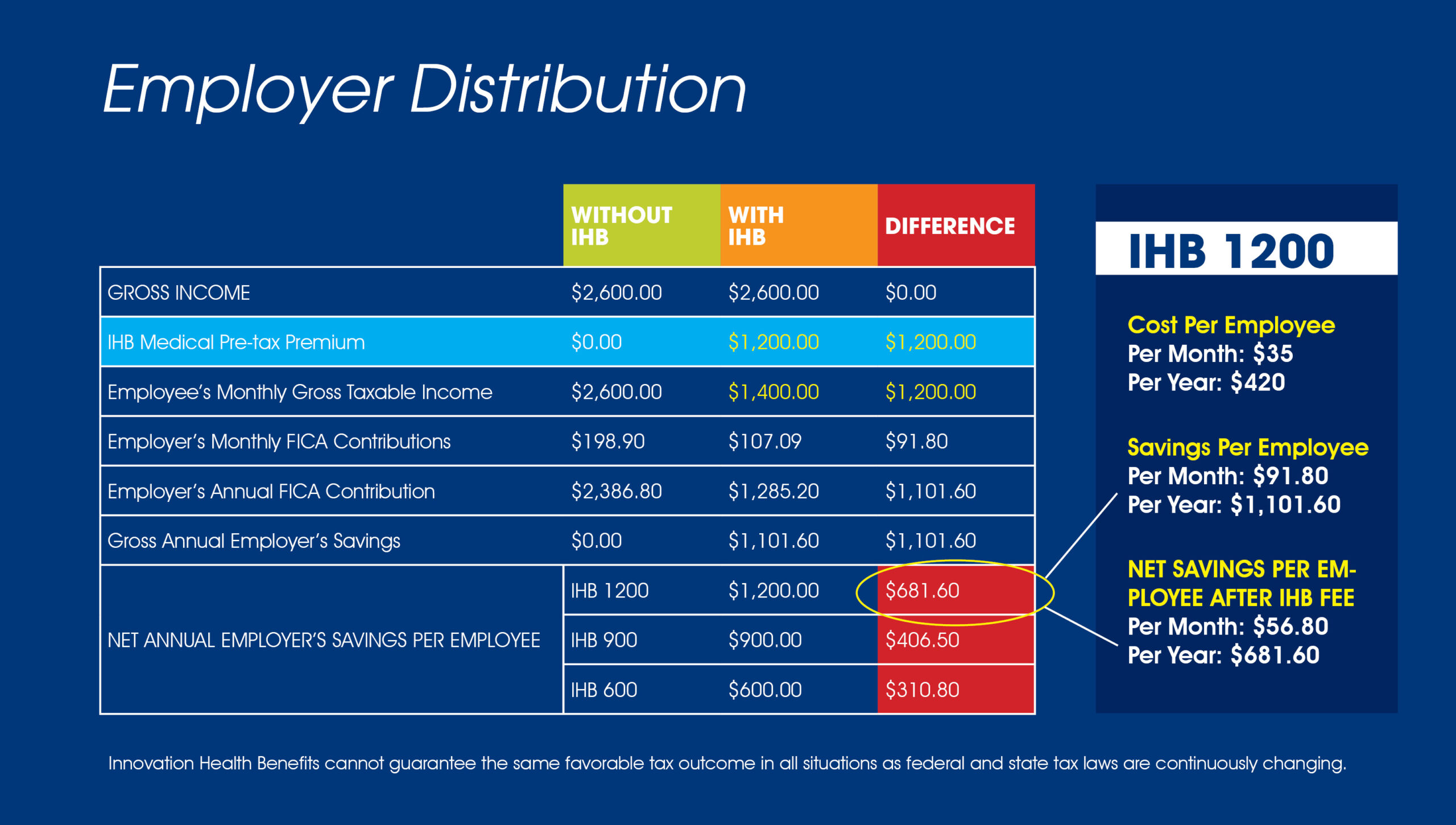

IHBTM - Employer and employee tax and work comp saving example

IHBTM is a comprehensive preventative health care program designed to integrate seamlessly with existing insurance plans. It simplifies the process of prioritizing preventative care and offers rewarding benefits for your employees. Fully HIPAA-compliant, IHBTM is a participatory medical expense reimbursement wellness plan that adheres to IRS codes 125, 216, and 105, and is supported by a legal protection plan.

Program Highlights:

Employer Savings:

– Employers will experience significant savings, including an approximate $681.60 FICA tax savings per employee per year. For example, an employer with 500 employees will save around $340,800 annually, enhancing the company’s bottom-line profits at no cost to the employer.

– Additional savings on Worker’s Compensation insurance.

Employee Benefits:

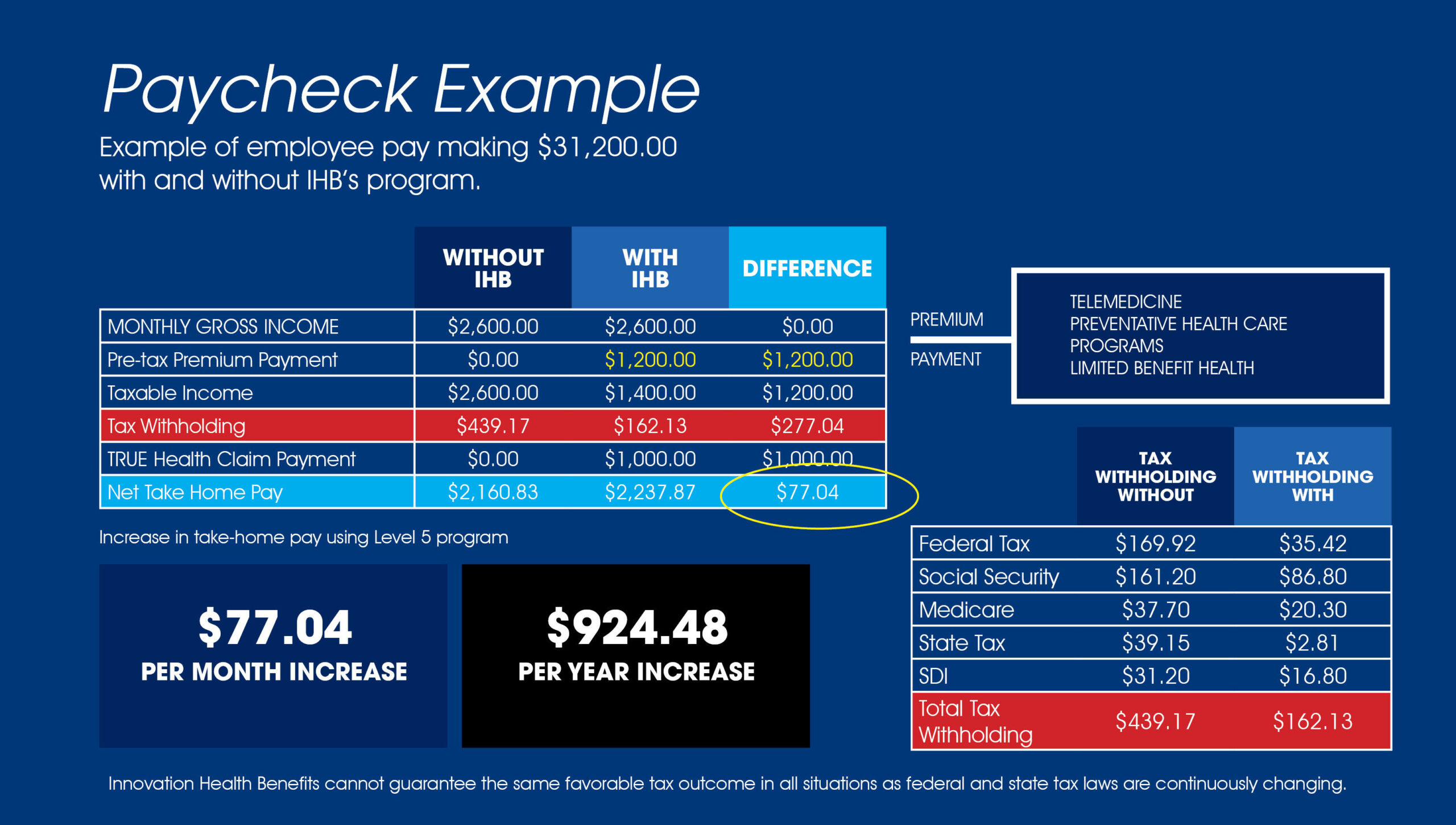

– Employees will see an increase in their net take-home pay by approximately $77.04 monthly and $924.48 annually.

– Every qualified employee will receive additional supplemental indemnity benefits designed to complement, not replace, any existing employer-sponsored plan. This means employees receive valuable health benefits and an increase in their take-home pay, all at no cost to them.

Example Analysis:

Consider an employee with a pre-tax gross income of $2600 per month:

– Without IHBTM: The FICA tax is calculated on the full gross income of $2600, resulting in an employer FICA contribution of $198.90.

– With IHBTM: A pre-tax premium of $1200 is deducted from the employee’s gross income, reducing the taxable income to $1400. The FICA tax is now calculated on the reduced taxable income of $1400, resulting in an employer FICA contribution of $107.10. The employer saves $91.80 monthly, totaling an annual savings of $1,101.60.

The IHBTM program fee is $35 per employee per month, totaling $420 per year. The net employer savings after the program fee is $56.80 per month and $681.60 annually.

Employee’s Take-Home Pay:

– Without IHBTM: Taxable withholdings are calculated on the full gross monthly income of $2600, resulting in withholdings of $439.17.

– With IHBTM: A pre-tax premium of $1200 is deducted, reducing the taxable income to $1400. The tax withholdings on this reduced income are $162.13, leading to a monthly reduction in withholdings of $277.04. Additionally, the employee receives a claim payment of $1000, resulting in a net take-home pay of $2,237.87, which is $77.04 more per month and $924.48 more annually than without IHB.

Advantages of IHBTM Section 125 Cafeteria Plan:

A Cafeteria Plan governed by Section 125 of the Internal Revenue Code offers several advantages:

– Tax Savings: Employees benefit from lower taxable income, reducing their federal and state income taxes as well as Social Security and Medicare taxes.

– Flexibility: Employees can customize their benefits to suit their specific needs and circumstances, choosing from a variety of options.

– Cost Savings for Employers: Employers save on payroll taxes due to the reduction in employees’ taxable income, leading to overall cost savings.

– Attraction and Retention: Offering a Cafeteria Plan helps attract and retain employees by providing a more comprehensive and customizable benefits package.

Contributions to an IHBTM Section 125 Cafeteria Plan are made on a pre-tax basis, lowering the wages subject to federal income tax, Social Security tax, and Medicare tax. Since workers’ compensation premiums are often calculated based on total payroll, reducing taxable wages can directly decrease premium costs for workers’ compensation insurance.

Compliance and Legal Protection:

IHBTM goes beyond basic wellness programs by offering an extra layer of security and compliance. This has been achieved through a full audit by a law firm to ensure IRS compliance. IHBTM provides legal protection of up to $500,000 for your company and $10,000 per employee to shield you from potential financial burdens in case of a government audit. The law firm proactively monitors legal developments to address potential issues before they arise, allowing you to offer a compliant wellness program with peace of mind.